The Honorable Steven T. Mnuchin

Secretary of the Treasury

Department of the Treasury

1500 Pennsylvania Avenue, NW

Washington, DC 20220

The Honorable Robert Wilkie

Secretary of Veterans Affairs

Department of Veterans Affairs

810 Vermont Avenue, NW

Washington, DC 20571

Dear Secretary Mnuchin and Secretary Wilkie:

On behalf of the millions of veterans, families and survivors our organizations represent, we call on you to take whatever actions are necessary to identify and electronically pay Recovery Rebates to recipients of Department of Veterans Affairs (VA) benefits who do not file federal tax returns and are eligible for these payments. We are gravely concerned that absent quick and decisive action from the Administration, millions of seriously disabled veterans, their survivors and caregivers – who are among the most vulnerable Americans during the ongoing coronavirus health crisis – may never receive this critical financial support.

As you know, Public Law 116-136, the Coronavirus Aid, Relief, and Economic Security Act authorizes Recovery Rebates for most American adults, subject to certain eligibility and income requirements. However, the primary method the Internal Revenue Service (IRS) will use to identify eligible individuals is federal tax returns for 2018 or 2019. Unfortunately, this approach will leave out a significant number of people who have little or no income and are not required to file a federal tax return, including many seriously disabled veterans and their survivors, as well as Social Security recipients and other low-income individuals.

In recognition of this fact, the law included an alternate method to identify Social Security and Railroad Retirement beneficiaries who do not file federal tax returns; and on April 1, the IRS determined that it would identify and pay these individuals their Recovery Rebates, without requiring them to file new tax returns.

Regrettably, the law did not include a similar provision for disabled veterans or their survivors, so unless new action is taken by the Departments of Treasury and Veterans Affairs, these non-filers will only receive a Recovery Rebate if they file a tax return, which for many is a significant burden, particularly during this health emergency. Experts who looked at prior economic stimulus payment programs, particularly the Economic Stimulus Act of 2008 (P.L. 110-185), have estimated that requiring these physically and economically challenged individuals to file a new tax return will likely result in millions never filing and therefore never receiving this desperately needed financial support. By contrast, the American Recovery and Reinvestment Act of 2009 (P.L. 111-5) included specific provisions to identify and make direct payments to VA beneficiaries and Social Security recipients in recognition of the shortfalls of the 2008 law.

Secretary Mnuchin and Secretary Wilkie, while there may be logistical or even legal obstacles to overcome, it is critically important that you and your Departments work together to prevent potentially millions of disabled veterans and their survivors from losing this financial support.

The federal government already has within its custody sufficient information to identify VA beneficiaries – including those receiving disability compensation, pension, Dependency and Indemnity Compensation (DIC) and other non-taxable payments – and can cross reference them with IRS taxpayer records and Social Security recipients. Furthermore, VA has direct deposit information for its beneficiaries that can be used to rapidly make these critical payments. With your leadership, we are confident all obstacles can be overcome to take care of the men and women who served, their families and survivors.

We thank you for all your efforts during this national health and economic emergency and stand ready to support you in any way we can.

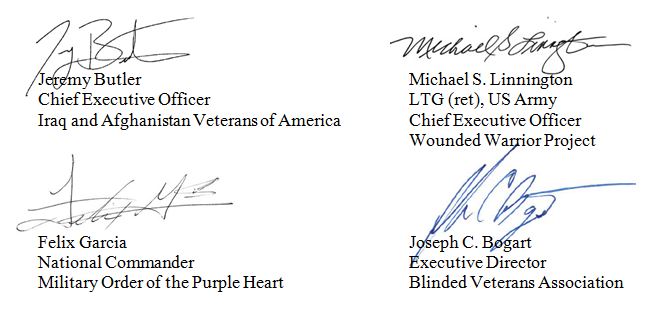

Respectfully,

Cc:

Senator Chuck Grassley, Chairman, Senate Finance Committee

Senator Ron Wyden, Ranking Member, Senate Finance Committee

Congressman Richard Neal, Chairman, House Ways and Means Committee

Congressman Kevin Brady, Ranking Member, House Ways and Means Committee

Senator Jerry Moran, Chairman, Senate Veterans’ Affairs Committee

Senator Jon Tester, Ranking Member, Senate Veterans’ Affairs Committee

Congressman Mark Takano, Chairman, House Veterans’ Affairs Committee

Congressman Phil Roe, M.D., Ranking Member, House Veterans’ Affairs Committee